Introduction

Managing money in 2025 is easier than ever thanks to finance apps. From mobile banking to budgeting tools, these apps help you save, spend, and invest wisely—all from your smartphone.

Here are the Top 4 finance apps in 2025 that can make your financial life more secure and organized.

1. PayPal – Global Digital Payments

PayPal remains one of the most trusted payment apps worldwide.

Key benefits:

- Secure payments for online shopping.

- Easy money transfers across countries.

- Buyer protection for safe transactions.

- Integration with many e-commerce platforms.

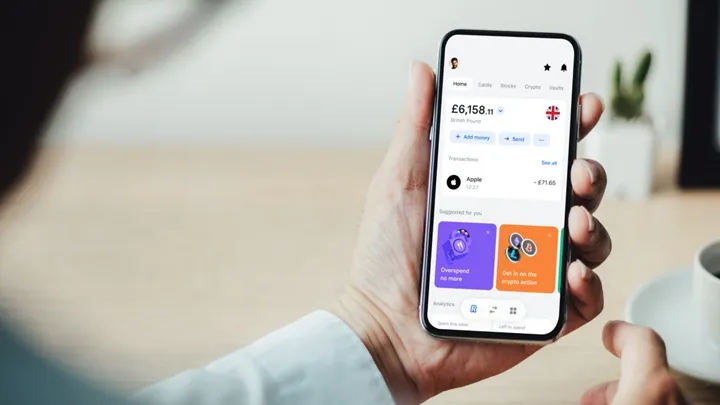

2. Revolut – Banking Without Borders

Revolut is a modern financial app designed for global users.

Key benefits:

- Multi-currency accounts with real-time exchange rates.

- Budget tracking and savings vaults.

- Crypto trading and stock investments.

- Travel-friendly with low foreign transaction fees.

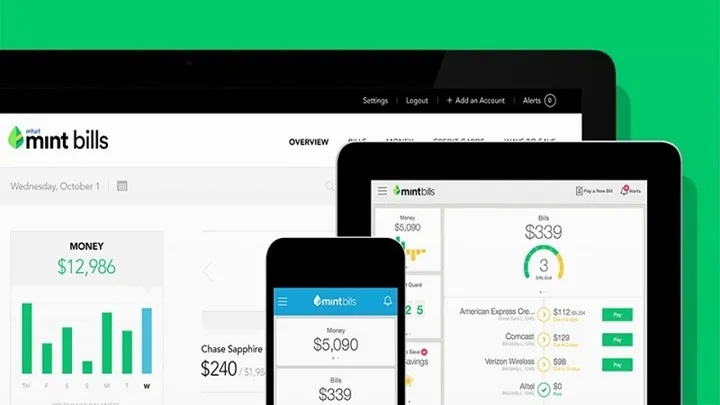

3. Mint – Budgeting Made Simple

Mint is perfect for anyone who wants to track spending and save money.

Key benefits:

- Automatically categorizes your expenses.

- Helps you set and reach savings goals.

- Bill reminders to avoid late fees.

- Clear financial overview in one dashboard.

4. Robinhood – Investing for Everyone

Robinhood makes investing accessible to beginners and experts alike.

Key benefits:

- Commission-free stock and ETF trading.

- Easy-to-use interface for new investors.

- Options to trade crypto and fractional shares.

- Educational resources for financial growth.

Conclusion

From PayPal’s global payments, Revolut’s borderless banking, Mint’s budgeting tools, to Robinhood’s easy investing, these apps represent the future of personal finance in 2025.

Whether you want to manage expenses, save smarter, or grow your wealth, these apps can help you take control of your money.